09.02.2023

What will the Venture Capital market look like in 2023?

The Venture Capital (VC) market has been growing rapidly in recent years. More and more investors, both private and public, see great potential in promising Polish technology companies and invest their capital in this sector. The situation on the market is also influenced by capital instruments co-financed by the European Union.

As late as the first half of 2022, there was talk among VC funds of a looming crisis related to, among other things, the end of the PFR Starter and NCBiR Bridge Alpha programs, a key source of funding for many young companies.

Read the article and find out:

- What will the slowdown in the startup market be due to?

- What makes public funds important for the development of Polish projects?

- What trends will we see in 2023?

We asked Michal Olszewski - an experienced business angel, venture capital and private equity specialist and fintech entrepreneur - about the above issues. Michal is a Partner at Movens Capital - a fund backed by PFR Starter, where he is responsible for venture capital investments.

Relevance of public funds in the Venture Capital market

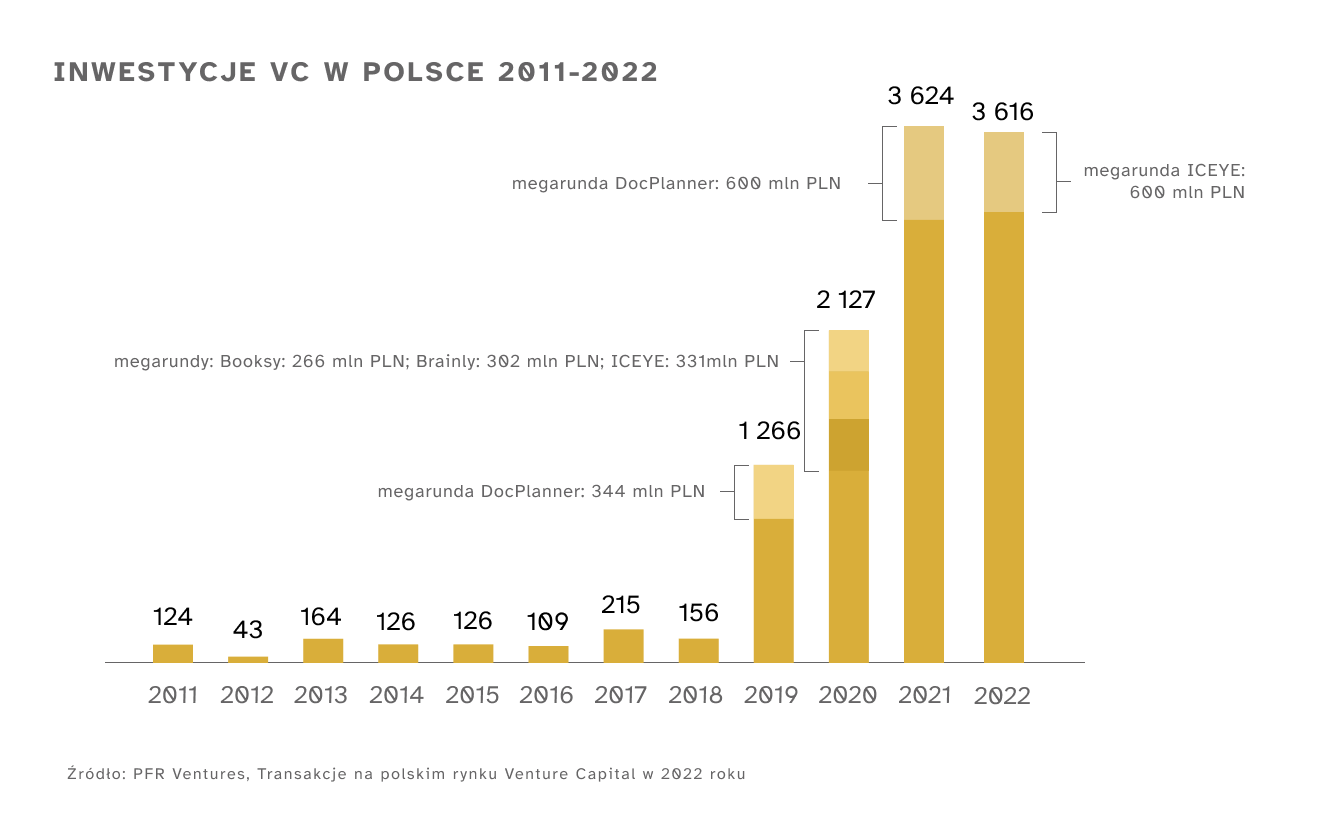

Since 2017, the Polish Venture Capital and startup market has seen dynamic changes. In recent years, an increase in interest in promising Polish technology companies has been observed among both private and public investors. The growing interest in investments in startups was particularly noticeable in the VC market, where, according to a report by PFR Ventures and Inovo, in 2021 the value of transactions was 40 percent higher than in 2020, and taking into account, estimated at PLN 600 million, DocPlanner's mega-round, the increase was nearly 70 percent year-on-year. The lack of slowdown in the Polish market was the result of a large commitment of public capital stabilizing our domestic market.

Currently, the startup market is starting to see a slowdown caused by increased uncertainty in the market and a reduction in the availability of cheap money. In addition, the current situation is affected by the expiration of competitions for EU funds, the implication of which will be fewer - but more thoughtful - investments in our region.

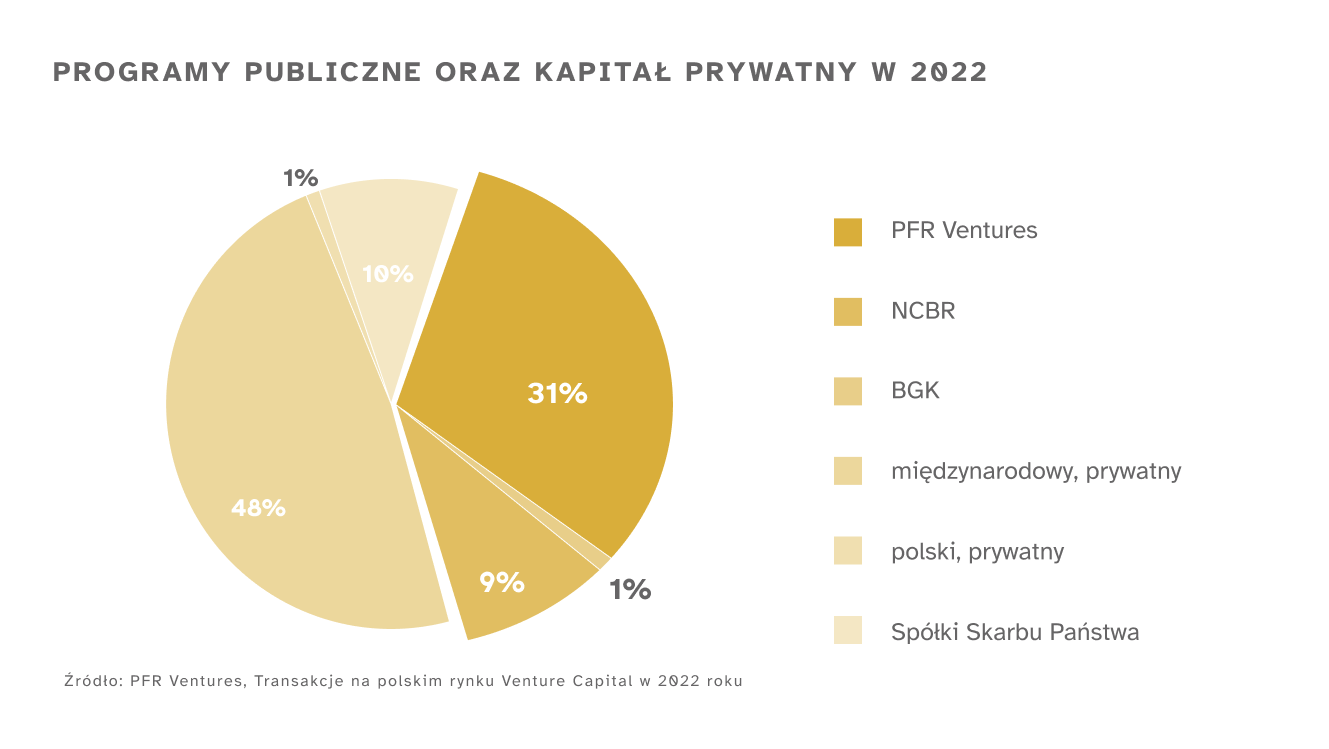

In 2022, the Venture Capital market decelerated maintaining a value of more than PLN 3.6 billion relative to 2021. In 2023, new public funds are expected to enter the market, accounting for 40% of the value of all deals concluded in Poland last year. Taking into account previous years, it can be seen that public funds are a key part of the Venture Capital market in Poland. For this reason, the industry is looking forward to the launch of the emerging FENG program, which will contribute to further records in future years.

- "The Polish VC market is heavily dependent on public funds, channelled mainly through PFR Ventures. That's where it's important to start by discussing the changes we are witnessing. First of all, this fund of funds for more than a decade of operation (taking into account its predecessor - PFR) has gathered a lot of experience and operates according to Western models - more and more efficiently and on a larger scale." - says Michal Olszewski, Partner at Movens Capital

What trends will we see in 2023 in the VC market?

Decline in valuations

According to experts, 2023 will be a year of decline in the value of the largest financing rounds and fewer deals, and the first signs of this trend were already observed at the end of 2022. High interest rates, rising inflation and uncertainty in the market have led to a shift of capital from high-risk instruments toward lower-risk instruments. As a result, a decline in startup valuations triggered by a correction in public company valuations is forecast. For example, the SaaS Capital Index, between January and December 2022, experienced a decline of about 44%!

The market is eagerly awaiting the date when EU funds will be unlocked under the 2021-2027 financial perspective, which is estimated for the first half of 2023. Mature companies looking to raise financing, as a result, may reduce their valuations in order to arouse the interest of activist investors looking to achieve a higher return over the next periods.

- "I expect fewer companies to raise financing in 2023, they will go to the best and generally at lower valuations. Software doesn't stop "eating the world" - on the contrary, the pace of this process is accelerating, so more disruptive companies changing their sectors will be created. Thus, investors with liquidity have a very interesting few to several months ahead of them." - indicated Michal Olszewski, Partner at Movens Capital.

However, if funds under the PFR or NCBR are not released in the coming months, you can expect startup valuations to become more realistic and tech companies to collapse!

- "The PFR is yet to conduct calls for new programs, and it is likely that funds from these new funds to startups will arrive at the end of the year at the earliest, with the main wave starting in 2024. Funds from previous funds, whose investment period ends in December 2023, will still be available. Some of the funds have used all or almost all of their budgets, so 2023 may turn out to be a year of relatively weak capital supply. This is also influenced by the weak economy outside Poland." - comments Michal Olszewski, Partner at Movens Capital.

Seed rounds

In 2022, we could see an increase in investor interest in pre-seed and seed rounds. This is mainly due to the lower valuations of fledgling startups and often better investment conditions. According to Young, companies will thus maintain their valuations as much as possible. Investing in early-stage startups is also associated with a longer time to exits - an opportunity may be on the lookout for wealthy investors committing their capital on a long-term basis who are looking for opportunities in weak times.

Growing interest in selected industries

In the coming months, PFR Ventures is grappling with the challenge of bringing money from the European Funds for the New Economy (FENG) program to market. It plans to announce the first investments in funds focusing on selected sectors. Among the areas the funds will be interested in in 2023 are startups and mature impact companies - those with beneficial and measurable social and environmental impact. This is especially true for innovative projects fighting climate change, the development of which is stimulated by, among other things, legislative packages like the European Green Deal aimed at reducing greenhouse gas emissions.

Investment in health innovation, including telemedicine and healthtech, is also forecast to be sustained. According to a report by PFR Ventures, titled. "Transactions in the Polish Venture Capital Market in 2022," in previous years these types of ventures accounted for 15% of the total number of transactions in 2020 and nearly 19% in 2021.

The Venture Capital market has seen an increase in investor interest in SaaS companies. In 2022, it is the companies operating in this business model that accounted for the largest share of the total number of deals - about 50%, thus maintaining a dominant position among investors.

What will the Venture Capital market look like?

The market is heavily influenced by the current economic situation, which can provide an advantage to companies at a higher stage of venture development. Investors will make their decisions more thoughtfully, focusing on the quality of companies.

Despite the coming market slowdown, the stream of new investments is forecast to continue, but investment rounds will not be as high as in 2020-2021.

- "Those already managing funds directly are also gaining experience. The number of professionals in the industry is also growing. This developed position can be expected to be an important factor in the allocation of new PFR funds. This, in turn, should lead to decisions relating to specific companies that will be more accurate, bolder, and the process itself can be and in a more efficient manner. Ultimately, there should be more companies with a global reach and a value in the hundreds of millions or billions of dollars." - believes Michal Olszewski, Partner at Movens Capital.

Investors will continue to be interested in companies in health-related industries known as healtech. Demand for innovation in this area continues to remain high, with about 14% of all transactions in 2022 conducted on health companies.

The war in Ukraine may stimulate interest in RES projects accelerating the energy transition. Investors' attention will be attracted to companies with a high degree of implementation and, consequently, a confirmed place in the market. Risk aversion accompanies more stable ventures, giving a lower return on investment, but with much lower risk.

Fewer companies will raise financing in 2023! If you want to increase your chances of attracting investor interest by preparing an effective pitchdeck - get in touch with us! We would be happy to tell you how we can help you.

Need an effective pitch dec for your start-up? Fill out the form