24.08.2021

Altman model - a tool for analyzing the financial health of a company

Key findings

- Edward Altman has constructed an indicator to assess a company's financial health based on five financial aspects (liquidity, profitability, financial support, solvency and turnover).

- Altman's index, despite its usefulness, has some limitations, including reliance on historical data and over-fitting to U.S. market conditions.

- Interpretation of the results of the Altman index involves comparing the score of the company under study with cut-off values that classify the company as at risk of bankruptcy, not at risk of bankruptcy or in the intermediate zone.

- Despite its drawbacks, it is valued for its proven utility in practice, low cost, transparency and ease of interpreting results.

- It is a useful tool for assessing bankruptcy risk, as well as for analyzing a company's liquidity, turnover, debt and profitability.

- There are also other methods of assessing financial health, such as ratio analysis, cash flow statement and debt analysis.

What is the Altman Model?

The Altman Model, also known in the literature as the Z-score Model, was developed by New York finance professor Edward Altman in 1968. The scientist, while analyzing dozens of failing companies in the financial capital of the world, noticed that there were several distinguishing characteristics that defined companies, and based on them he built a model that helps identify companies at risk of bankruptcy some time in advance.

The original indicator created by Altman was mainly concerned with listed US manufacturing companies and was not adapted to check the financial health of companies of other types, particularly companies operating outside the stock market, service and financial services companies and companies operating in markets less stable than the US.

Edward Altman, aware of the limitations of the original version of the index, began work on improving it. In 1984 he published a formula tailored to non-publicly valued companies, while six years later he presented a model useful for analyzing companies present in more volatile markets.

How to calculate the Altman Index?

The Altman model is one of the so-called bankruptcy prediction models. It is the first tool of its kind based on advanced mathematical apparatus - more precisely, on statistical discriminant analysis. Its purpose is to comprehensively evaluate a selected company, and at the same time to diagnose and indicate the characteristics of the company focusing on five elements (the number and nature of the elements depend on the selected version of the model):

- liquidity,

- profitability,

- financial support,

- solvency

- turnover.

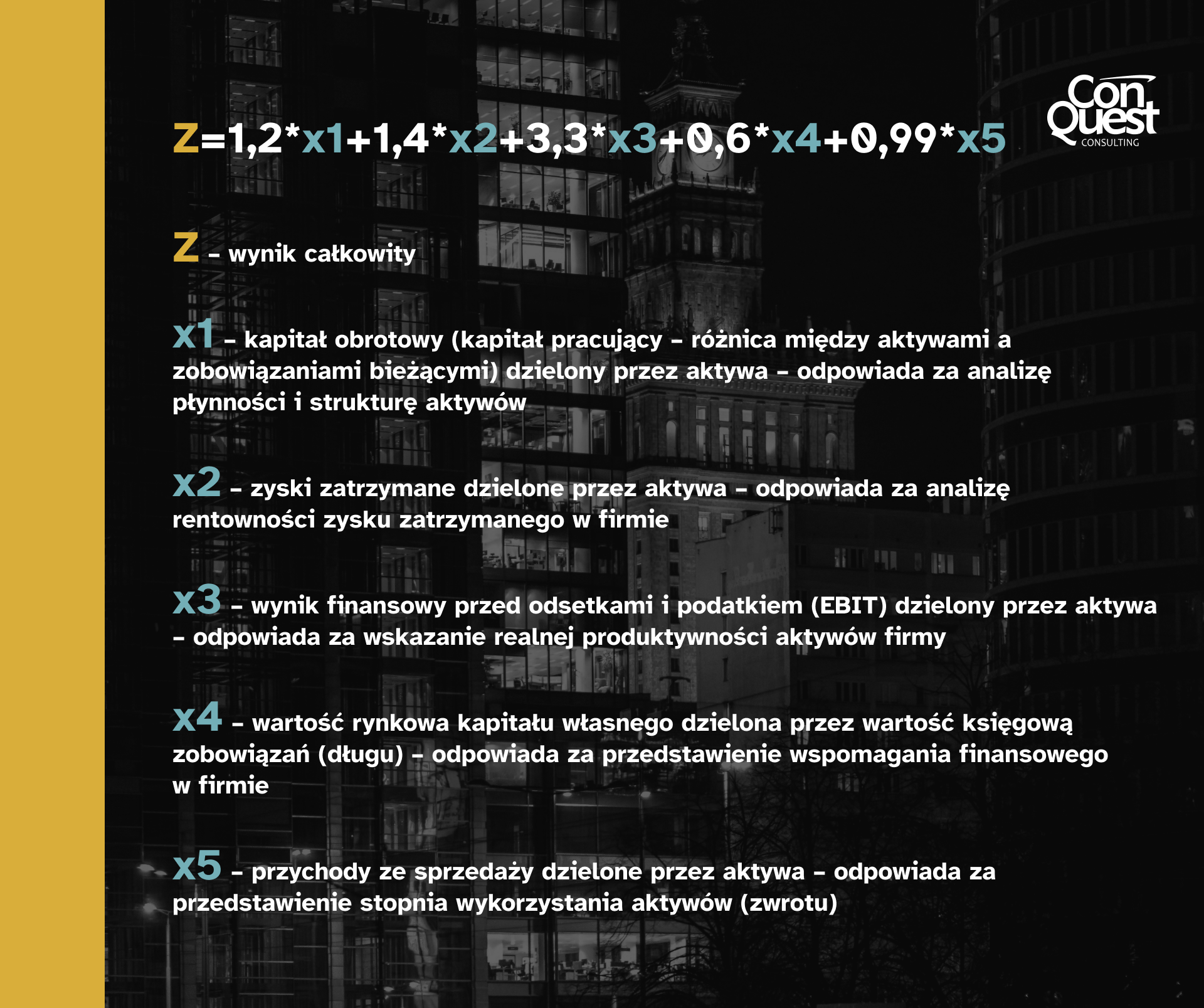

Appropriate coefficients were assigned to the five elements as a result of multivariate analysis. The weighted values of the coefficients signify the strength of change of each parameter, and thus the influence of a particular sphere of the company's finances on the final assessment in terms of bankruptcy risk. The summed weighted values reflect the picture of the company's financial condition. Most often, the Altman index is calculated using the following formula:

In place of the indicators reflecting the various aspects of the company's financial condition, insert the values obtained earlier, based on data from the company's financial reports. The total score (Z) represents the situation of bankruptcy risk, with the reliability of the forecast empirically confirmed - the probability of the indicator is about 80% a dozen or even several dozen months before bankruptcy.

Interpretation of the results

On the basis of historical data, a range of indicator volatility was determined for companies with different financial situations, ranging from companies with promising results and real growth opportunities, to companies at serious risk of losing liquidity and eventually bankruptcy.

Financial health is assessed by analyzing the value of a linear function, which is a weighted sum of the previously mentioned five elements. Based on its observations, the result of the company under study can be compared with the determined limit values, which classify the company in one of the three categories. With the results of empirical research and the obtained result of the financial condition of the analyzed company, the company can be placed in the ranges:

- < 1.81 - a range with a high risk of bankruptcy,

- 1.81-2.99 - intermediate range - in this zone, a company cannot be clearly classified as threatened or not threatened with bankruptcy,

- >2.99 - non-bankruptcy range.

The indicator, although it accurately informs about the current financial situation, is not the most important result of the whole analysis. That is why, within reason, one should not attach importance to the chosen version of the model. What matters most is the trend in which the analyzed company is moving. If cyclical surveys indicate that the company is moving toward a better financial situation, the owners should have no reason to worry. In the opposite case, measures should be taken to prevent the possible bankruptcy of the company.

Disadvantages of the Altman Model

Altman's model, is subject to certain errors. The main imperfection is that the indicator is based on historical data, which may contain outdated verifications of companies in the context of current economic realities. Therefore, the historically selected companies may not be representative of the study being conducted, which leads to a curvature of the analysis results.

In addition, many experts say that the Altman Model is too attuned to the conditions of the U.S. market, where the macroeconomic situation is different and there are differences in accounting systems compared to other countries. It has also been criticized in the economic literature for having other flaws typical of discriminatory models. These are primarily:

- limited presentation of financial health (e.g., limiting oneself to an insufficient number of aspects of a company's financial health and assigning overly important roles to particular ones),

- Inaccurate estimation techniques that reduce the weighted values of indicators and underestimate the level of the discriminant function, and consequently narrow the classification ranges.

Despite the drawbacks indicated, the popularity of discriminant analysis, including the Altman Model, remains important in predicting corporate bankruptcies. It owes this to its proven usefulness in practice, relatively low cost, transparency and ease when interpreting or comparing results.

Why is the Altman model a valuable tool?

The Altman model is an extremely valuable tool in assessing a company's financial health, providing a cross-sectional analysis of many aspects of business operations. Above all, it allows an accurate assessment of bankruptcy risk, which is invaluable for strategic business decisions. It focuses on analyzing four key financial indicators that reflect different areas of a company's operations, such as liquidity, turnover, debt and profitability.

Using the Altman model, a company is able to focus on the most important aspects of its financial activities. The use of the accounts receivable turnover ratio and inventory turnover ratio allows to assess the efficiency of current asset management. This type of analysis is extremely valuable for optimizing business processes and improving a company's profitability.

At the same time, debt analysis, which is an integral part of Altman's model, makes it possible to assess the financial risks associated with the level of debts. The debt-to-capital ratio provides information on whether a company is able to cover its liabilities, which has a direct impact on its liquidity and stability.

Assessing the financial health of a company versus the risk of bankruptcy

Assessing the risk of corporate bankruptcy is an integral part of evaluating a company's finances. Debt indicators, such as the debt-to-equity ratio, can be used to assess bankruptcy risk. There are four financial ratios to consider in Altman's model that provide a picture of a company's financial health and allow an assessment of bankruptcy risk. Analysis of a company's finances, of which bankruptcy risk assessment is a part, is therefore an important part of assessing a company's health.

Other methods used to assess financial health

Alternatives to Altman's model for assessing a company's financial health include a wide range of tools that focus on different aspects of the business.

A significant element in evaluating a company's finances is ratio analysis. They include not only liquidity ratios, but also profitability and operating efficiency ratios. Inventory turnover ratio and accounts receivable turnover ratio, are important in assessing how effectively a company manages its assets.

Cash flow statement, is an important tool in assessing the financial health of a company. It provides a picture of the stream of cash that the company generates and spends, which makes it possible to assess the company's ability to cover current liabilities and investments.

Debt analysis is another important tool in assessing financial risk. An assessment of a company's debt can estimate the risk associated with high levels of debt, and an indicator assessment of financial health can help determine the risk of bankruptcy.

Indicator analysis provides an estimate of a company's liquidity, showing whether it is able to meet its short-term obligations. The asset turnover ratio, as one of the financial measures, is often used in assessing a company's financial position.

Du Pont's analysis is an effective tool for assessing a company's financial health, combining key indicators such as net margin, asset turnover and leverage. This integrated method allows you to understand a company's sources of profitability and how effectively it uses its assets and debts. It is an essential tool for evaluating and understanding various aspects of a company's operations and finances.

Summary

In order to ensure the proper operation of the company, it is necessary to constantly take care of its financial condition. It is important to remember that loss of liquidity in a company does not happen overnight, but is a process started by wrong management decisions, which can last even years.

Noticing early enough indications of the looming specter of bankruptcy can save a company from bankruptcy, which is why you should regularly reach out for services related to strategic consulting and support the company's growth using various analytical tools.

Altman's model conveys extremely important information to decision-making bodies or investors, but decisions should not be made solely on the basis of a single indicator. To maximize the effectiveness of instruments such as it, a full analysis of the company, as well as the opportunities and threats awaiting it in the market, should be conducted.